On the third day of Mortgage Bankers Association National Secondary Market Conference and Expo in New York City, three economists took the stage to explain their view of the housing market, and their forecast for 2017.

Freddie Mac Chief Economist Sean Becketti, Fannie Mae Chief Economist Doug Duncan and MBA Chief Economist Mike Fratantoni gave their projections over the chance of a recession within the next 12 months.

Becketti emphasized that while the chance of a recession increased, it would need to be driven by a specific event.

“Recessions are event driven, the economy doesn’t just run out of gas and slow down,” Becketti said.

Fratantoni predicted a 15% to 20% chance of a recession over the next 12 months, while Duncan pushed it to a 30% chance. He listed several factors including a peak in consumer credit card usage, auto sales and corporate debt, which could point to a looming recession.

The three economists pointed out that while employment is rising, there are still gaps in the growth.

What we’ve seen has been a polarization of jobs, Becketti said. Jobs have left the mid-skill level and gone to the high-skill level, and low skill jobs have also seen growth. The reason for this shift is that mid-skilled jobs are easier to automate.

But even as jobs polarize, the growth between urban and suburban areas leveled out, becoming more equally distributed between the two areas, Duncan said. However, this leveling out in the location of jobs is creating more problems in the housing market.

“But now urban areas are the most difficult area to build entry-level housing due to cost of land,” he said.

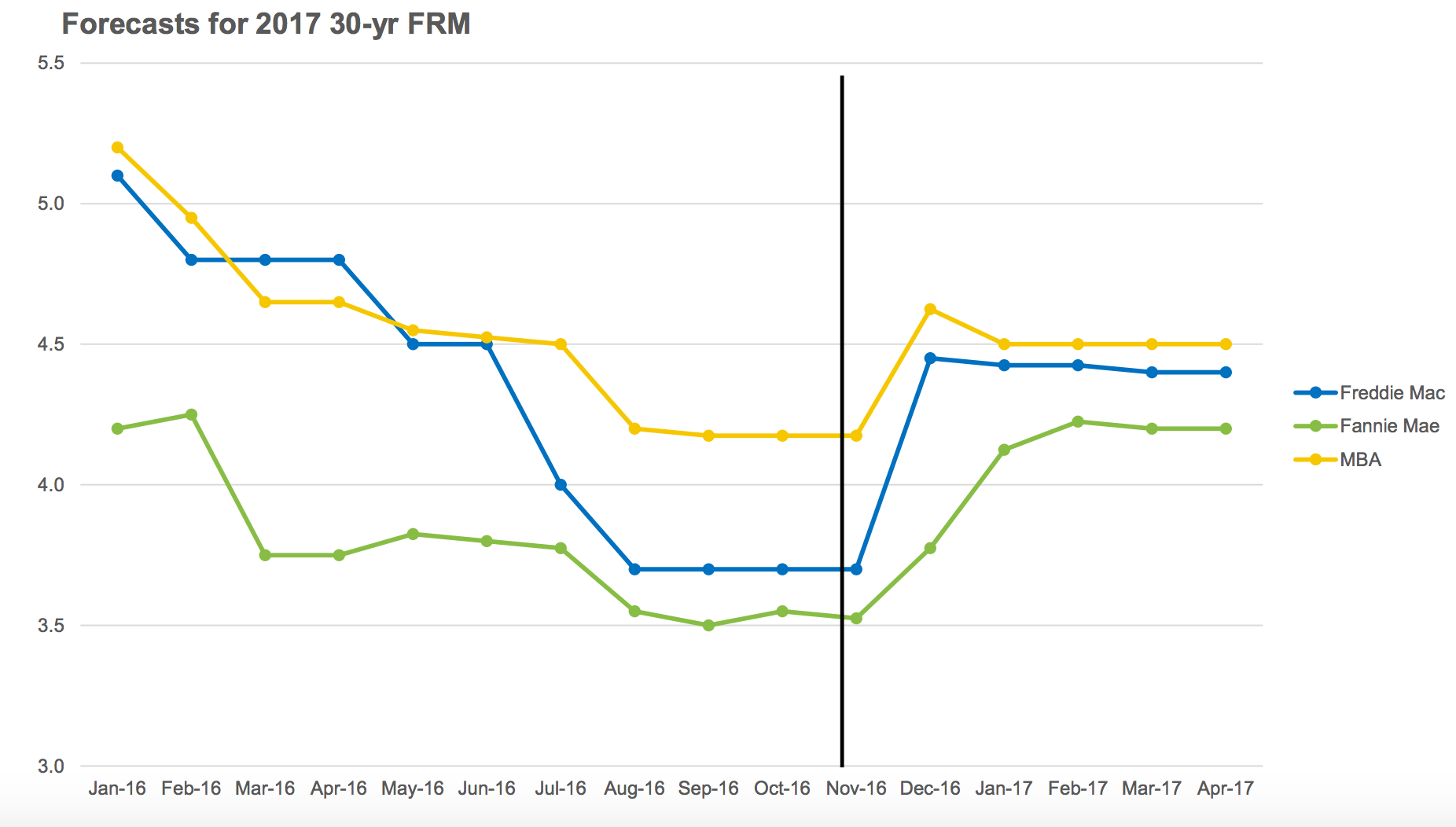

As the year goes on, Fratantoni predicted the market will see two more rate hikes – one in June and one in September, saying the year would finish with a 30-year fixed-rate mortgage rate of 4.5%.

Becketti predicted slightly more, saying the Federal Open Markets Committee could raise rates from two to three times this year, but said the year will end with a 30-year FRM of about 4.4%.

Duncan, who predicted the highest chance of a recession in the next 12 months, agreed the Fed will raise rates twice more this year, however kept it’s rate for the end of 2017 more conservative at 4.2%.

“We’re not convinced that inflationary pressures are enough to make the Fed more aggressive,” he said.

Click to Enlarge

(Source: Freddie Mac)

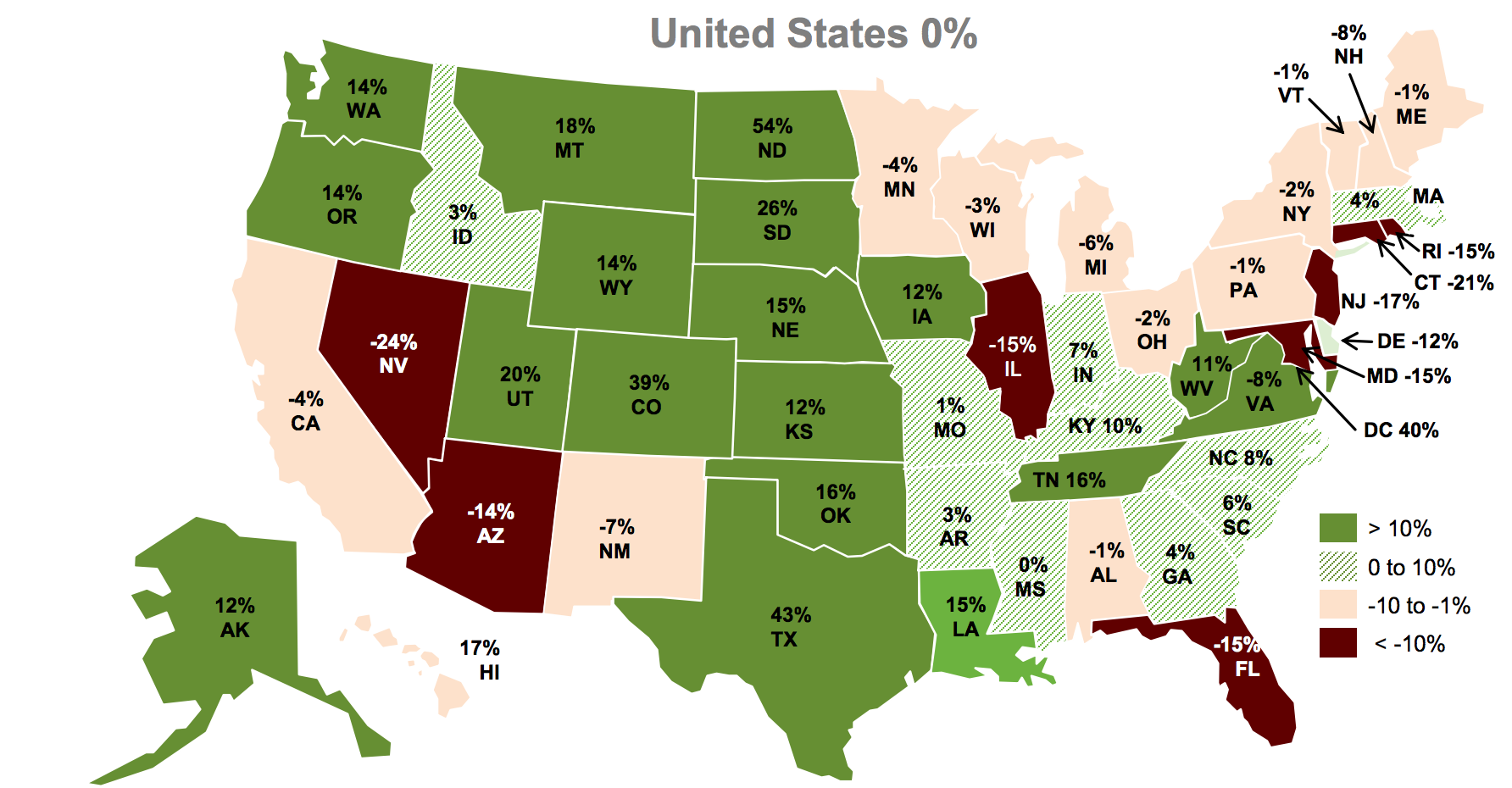

But for now, the housing market continues to boom as home prices hit their previous peak nationally, and even significantly surpassed it in some states.

This map shows the states in relation to their former peak:

Click to Enlarge

(Source: MBA)

All three economists were puzzled by the substantial increase in Texas, saying they could only venture to guess that while there is plenty of land to spread out in the state, the jobs are more centered, driving home prices up in key areas, such as Dallas.

And what about the rumored housing bubble? Fratantoni asked: Is San Francisco in a housing bubble? Becketti’s answer, to put it simply, was no. He answered that the city is subject to a tech collapse, but said it will not collapse on account of affordability.